In case you haven’t noticed, 2022 got off to a rocky start for global financial markets.

- The Nasdaq 100, which is an index that tracks the biggest names in US tech stocks, fell by 8.5% in January - its biggest monthly drop since December 2018.

- Also last month, the S&P 500, an index which tracks the performance of 500 leading companies in the US stock market, fell into a ‘technical correction’. A ‘technical correction’ is when the price of an asset falls by 10% or more from its recent high.

- The benchmark dollar index (DXY) surged past the 97.0 mark - a level not seen since July 2020 (ah, the good ol’ days when the whole world was cooped up at home).

A lot of these wild swings across the markets are being blamed on the Fed!

What is the Fed and what does it do?

The Federal Reserve is the central bank of the United States of America. It is in charge of the financial system (think of banks and other institutions that lend out or take deposits) of the world’s largest economy, which makes the Fed the most important central bank.

One of the main jobs for the Fed is to make sure that the prices that US consumers pay don’t rise too much too quickly.

Unfortunately for consumers, that’s been happening a lot of late. In December 2021, inflation in the US rose by 7% compared to prices in December 2020. That was the biggest climb for the consumer price index (the CPI measures the rate of inflation) since 1982. The CPI for January 2022 is forecasted to climb even higher, perhaps by 7.3%.

Of course, the Fed wants to protect the public and make sure they can continue spending money to help grow the economy. When things get too expensive, consumers may not be able to afford as much goods and services. When overall spending sees a big drop in an economy, that would negatively affect the income that businesses and producers get, which could lead to cost-cutting, job losses, etc.

Inflation that’s out-of-control is bad news for the economy.

Why is inflation soaring?

As economies continue opening up and moving past the pandemic, people are now able to spend more of their money on goods and services (e.g. dining out at restaurants, take vacations, upgrade their laptops as they return to the office, etc.).

However, many suppliers are still disrupted by Covid-19. Think of a factory or a port in Asia that has to shut down temporarily due to an outbreak. This means a particular product can’t be made or shipped, causing delays to customers who want it now. Or consider a chef who's confirmed to be Covid-19 positive, which means the entire kitchen staff who were in close contact have to be quarantined. Diners in the area would then have one less place to dine out. Also, many people have become reluctant to return to work since the pandemic. This shortage of workers have forced many businesses to raise their wages to attract more workers so that they business can meet the rising demand. Ultimately, many of these businesses wish to pass on those higher wage bill onto their customers; hence rising prices.

In short, too much money chasing still-scarce goods/services = soaring inflation.

How does the Fed plan to tame inflation?

- Interest rate hikes

When interest rates rise, it becomes more expensive to borrow money. Also, people may be more enticed to park more money in their bank accounts to earn the higher interest rates.

This results in less money sloshing about an economy (reduced money supply). As a result, producers and suppliers may then be forced to lower their prices to attract customers to still purchase their goods and services. Hence, the taming of inflation (hopefully).

As things stand, markets expect the Fed to raise interest rates by 25 basis points, from near-zero to 0.25%, on March 16th.

- Quantitative tightening

QT is when the Fed stops creating money out of thin air that have been used to buy bonds issued by banks. When the Fed stops buying those bonds, it essentially reduces the money that banks have to lend out to people (reducing money supply). When businesses/consumers have less borrowed money to spend, it is hoped that the reduced money supply would help drag down consumer prices as well.

Since the pandemic, the Fed has doubled its balance sheet to nearly US$ 9 trillion (that’s the number 9 followed by 12 zeros). Now, the central bank is starting to consider when to reduce the size of its balance sheet.

That’s a lot of money that could be sucked out of markets/the financial system, which is what investors and traders are concerned about.

How do higher interest rates/quantitative tightening affect markets?

- Tech/growth stocks have been falling

The share prices of many tech companies are valued on what they could potentially earn in the future, with little to zero profits to show at present. A lot of that growth may be dependent on how cheap it is to borrow money to grow the business.

As interest rates rise, the borrowing costs for these so-called “growth stocks” also rise in tandem. With more money needed to pay back those loans, as opposed to using that money to grow the business, it suggests that the potential profits in the future could be lower. Hence, tech/growth stocks have fallen drastically in recent weeks.

- The US dollar tends to rise

Since the pandemic, the Fed had been buying up trillions of dollars of bonds, including US Treasuries that are issued by the government. As quantitative tightening kicks off (potentially sometime in 2022), demand for these bonds is set to drop.

When the markets sell off these Treasuries but demand is weak, the prices of Treasuries fall but their yields rise. Yields are a measure of how much an investor can earn from a particular asset. Rising yields then, in turn, eventually attract more demand for those Treasuries and investors need US dollars to buy those assets.

In short, higher Treasury yields = more eventual demand for Treasuries = more demand for US dollars to buy those Treasuries = stronger US dollar.

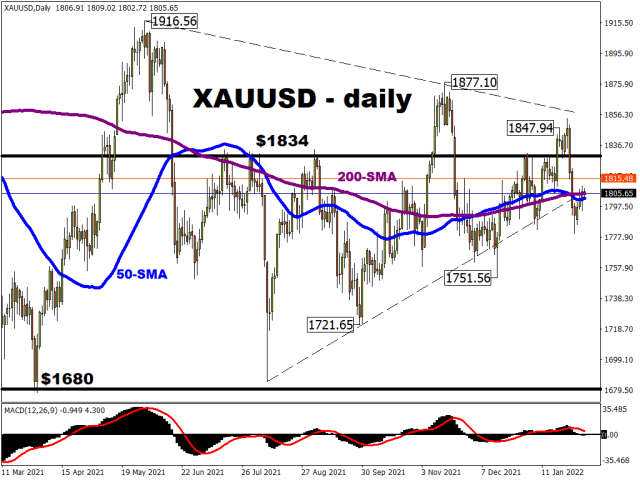

- Gold could fall further

As Treasury yields climb higher, investors become more attracted to the prospects of earning more from holding those government bonds, as opposed to gold which offers zero-yield. This could mean more declines in the future for gold prices as Treasury yields rise and take the shine off the precious metal.

Keep in mind that markets are forward-looking in nature, meaning that today’s prices are a reflection of what investors/traders think could happen in the future.

Hence, no surprise that the big drop in the Nasdaq 100 as stated at the beginning of this article, and the rise in the US dollar which has strengthened against most other G10 currencies.

As markets continue to sharpen their expectations for Fed rate hikes and the eventual QT, there’s likely to be more wild swings (volatility) across markets, as investors and traders continue pricing in their fears and concerns for what’s to come.

Overall, the slightest clues about what the Fed says about its plans to raise interest rates or reduce its balance sheet are set to rock markets, including stocks, bonds, currencies, and even gold.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.