Market sentiment improved on Wednesday with equities rebounding after suffering their biggest fall since May in the previous session.

We already knew this would be an eventful week for financial markets thanks to the numerous speeches from central bankers’ and key economic reports. So far markets have certainly not disappointed, especially after global stocks tumbled on Tuesday as U.S government bond yields rallied on expectations of an earlier-than-expected Fed rate hike. Despite the sense of calm today, more market volatility could be on the cards due to the pending speeches from various policymakers.

There were a couple of movers and shakers in the foreign exchange and commodity markets today.

While the fundamentals behind the movements are important, our attention will be on the technicals with 10 potential setups in focus.

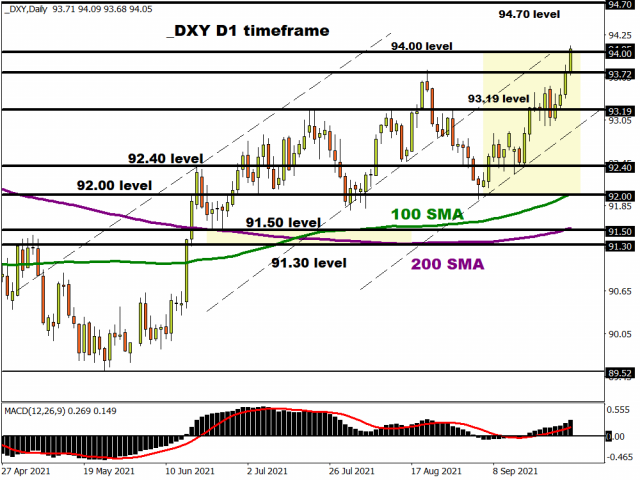

Dollar Index reaches new 2021 high

The Dollar Index (DXY) has been on a tear since early September with bulls charging through multiple walls of resistance with such destructive force. Prices remain heavily bullish on the daily charts as there have been consistently higher highs and higher lows. A solid daily close above 94.00 could open a path towards levels not seen since September 2020 above 94.70.

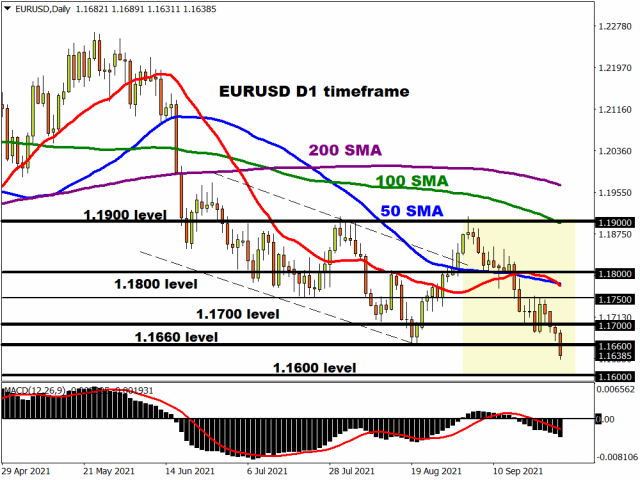

Euro bows to king dollar

An appreciating dollar has dragged the EURUSD to levels not seen since November 2020. Prices are trading around 1.1640 as of writing and may extend losses towards 1.1160 if 1.1700 proves to be reliable resistance. Lagging indicators in the form of the MACD and 50,100 & 200 Simple Moving Average favour further downside. Bears remain in control below the 1.1750 higher low.

GBPUSD collapses lower

Have you seen the GBPUSD? It is not looking too pretty this week, falling almost 250 pips since Monday. It looks the Pound remains pressured by a stronger dollar and fears over the UK suffering significantly from the global energy crisis. Prices are trading below 1.3500 and may extend losses towards 1.3400 or even lower this week. For bulls to snatch back control, prices need to push back above 1.3750 which looks like a steep hill to climb for buyers.

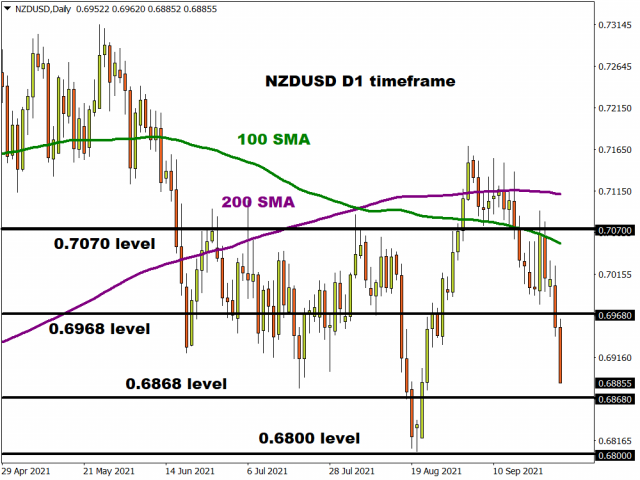

NZDUSD lower lows and lower highs

A breakdown opportunity could be forming on the NZDUSD. The currency pair remains under pressure on the daily charts with prices struggling to keep above the 0.69 support level. If bears secure a solid close below this point, this may signal a decline towards 0.6868 and 0.6800, respectively.

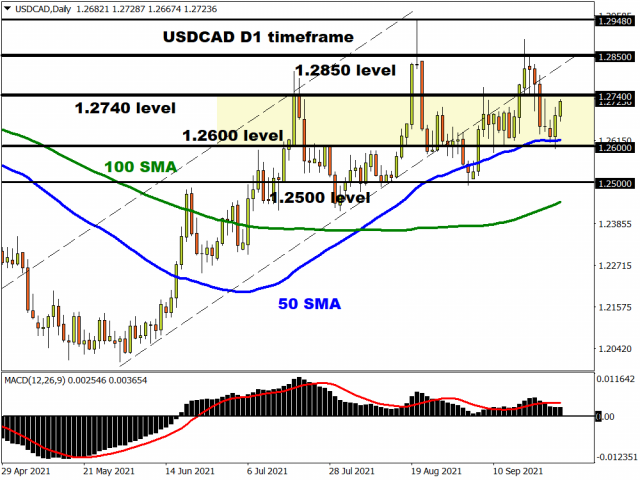

USDCAD remains in wide range

After bouncing from the 1.2600 level, the USDCAD seems to be making its way towards the 1.2470 resistance level. Prices remain in a range with a breakout opportunity on the horizon. Should prices secure a solid daily close above 1.2740, this may signal an incline towards 1.2850 and 1.2948. Alternatively, a decline below 1.2600 could open the doors towards 1.2500 and 1.2430.

Is the party over for the S&P500?

After the sharp selloff witnessed in the previous session, the S&P 500 is trading dangerously close to the 100-day Simple Moving Average. A decline below this point could signal further downside with 4225 acting as the first key level of interest. Below 4225, prices have the potential to test 4180.

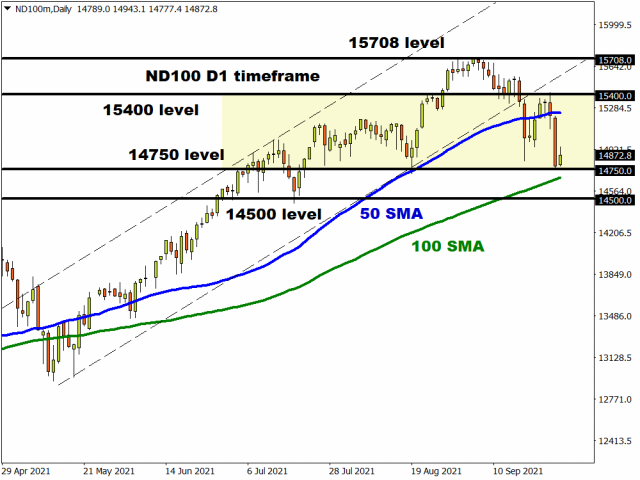

Nasdaq hit by rising U.S Yields

The Nasdaq may struggle to nurse the wounds from Tuesday’s selloff if U.S Treasury yields continue to rise. Prices are under pressure on the daily charts with 14750 providing minor support. A breakdown below this point could trigger a selloff towards 14500 and lower.

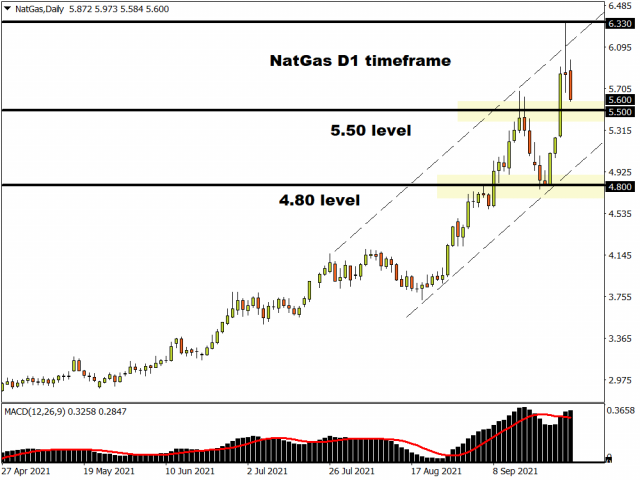

Natural Gas hits 7 year high…

US Natural gas prices have hit their highest levels since 2014 this week, outpacing oil and many other commodities. Although prices are heavily bullish on the daily timeframe, a technical pullback could be on the table before the upside resumes. It will be interesting to see how prices behave around 5.5 and 4.8.

Brent bulls in the building

Brent oil hit a new 2021 high on Tuesday, almost hitting the $80/bbl mark for the first time since October 2018. Although prices remain heavily bullish on the daily charts, a pullback towards $75 may be around the corner before bulls re-enter the scene.

Gold sinks below $1745

After depreciating due to a stronger dollar and higher treasury yields, gold initially entered Wednesday's session on a positive note with prices rebounding towards the $1745 level. Prices later depreciated with bears eyeing $1725 as the first key point of interest. Over the next few days, the metal's outlook may be influenced by speeches from central bankers’ and the August print for the Fed’s preferred inflation gauge.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.